Claims Under Commercial Property Insurance Policies for Losses Caused by Coronavirus

I. INTRODUCTION

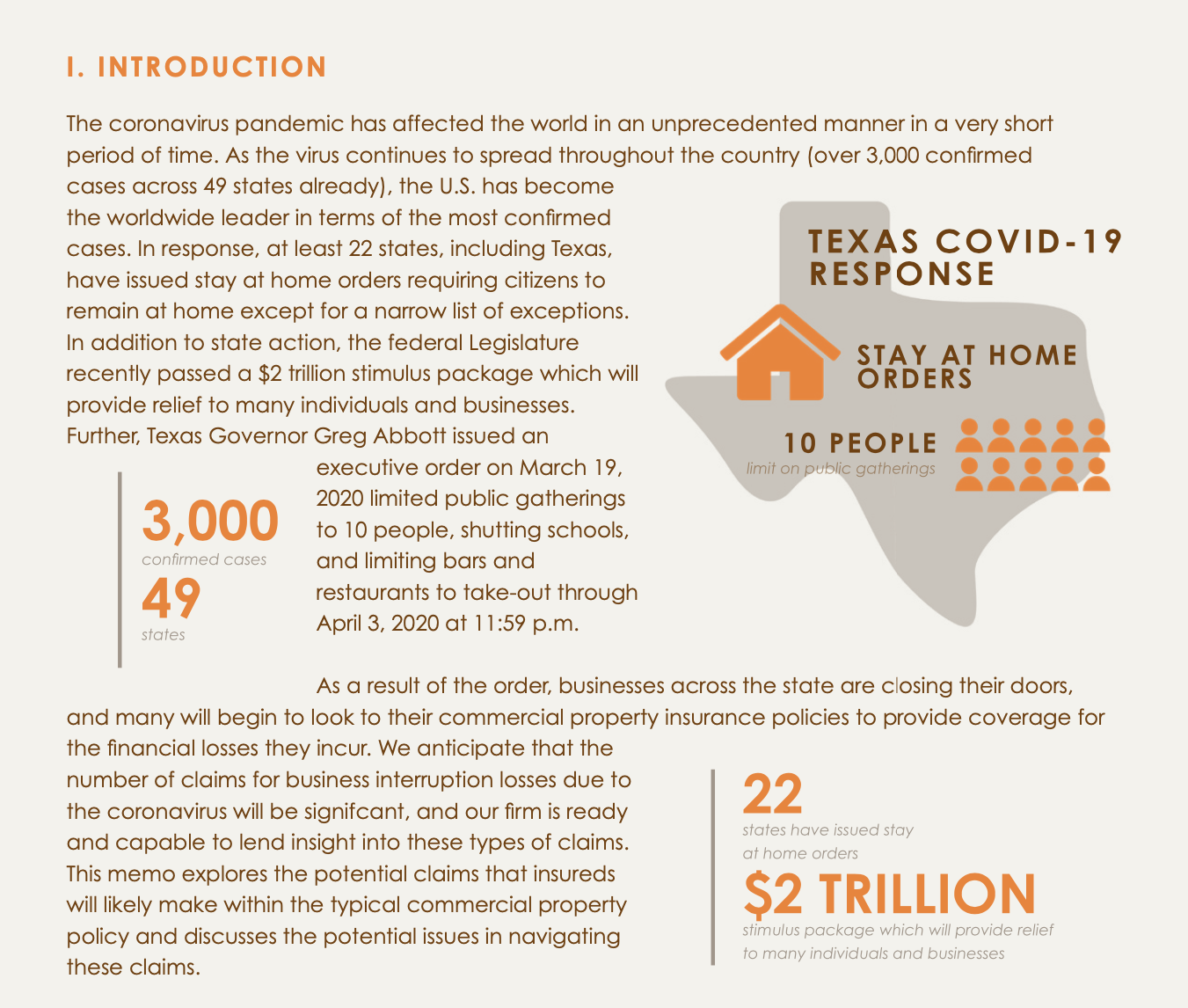

The coronavirus pandemic has affected the world in an unprecedented manner in a very short period of time. As the virus continues to spread throughout the country (over 3,000 confirmed cases across 49 states already), the U.S. has become the worldwide leader in terms of the most confirmed cases. In response, at least 22 states, including Texas, have issued stay at home orders requiring citizens to remain at home except for a narrow list of exceptions. In addition to state action, the federal Legislature recently passed a $2 trillion stimulus package which will provide relief to many individuals and businesses. Further, Texas Governor Greg Abbott issued an executive order on March 19, 2020 limited public gatherings to 10 people, shutting schools, and limiting bars and restaurants to take-out through April 3, 2020 at 11:59 p.m.As a result of the order, businesses across the state are closing their doors, and many will begin to look to their commercial property insurance policies to provide coverage for the financial losses they incur. We anticipate that the number of claims for business interruption losses due to the coronavirus will be significant, and our firm is ready and capable to lend insight into these types of claims. This memo explores the potential claims that insureds will likely make within the typical commercial property policy and discusses the potential issues in navigating these claims.

II. POTENTIAL CLAIMS

A. Business Interruption

The most popular claim that will be made by businesses in the wake of mass closures is for business interruption coverage, which is intended to protect an insured against disruptions and closures to its operations.Under most commercial property insurance policies, coverage for business interruption will only trigger when there is a "direct physical loss" to the premises that occurs from a "covered cause of loss". The first hurdle will be to show that there was a "direct physical loss" to the premises as a result of the coronavirus pandemic. While insurers will likely argue that the introduction of a virus is not a "physical loss," insureds will claim that the presence of the coronavirus itself is a physical loss, at least on a microscopic level. They may even do so by citing supportive case law that the presence of a harmful material or substance can constitute direct physical loss, i.e., asbestos. It is unknown at this time how Texas courts will settle on the issue of whether the presence of the coronavirus is a direct physical loss.Another issue that will arise in these claims is whether closure due to the coronavirus pandemic is a covered cause of loss. These policies will either:1) Specifically exclude infectious diseases/viruses from the list of covered houses of loss;2) Cover losses resulting from infectious diseases/ viruses under a policy endorsement with tis own sublimit;3) Neither exclude nor cover a policy endorsement.The first example will make coverage determinations relatively clear: if the policy specifically excludes infectious diseases and viruses (which would include COVID-19), then there will be no business interruption coverage under the policy as there was no covered cause of loss. However, if a policy only excludes "fungi or mold" and not "diseases," this may create coverage barring some other applicable exclusion.Regarding coverage under an endorsement, the specific language of the endorsement will of course be key to determine coverage. For example, the endorsement may only apply if the actual presence of the coronavirus at the property caused the business interruption, and not provide coverage if the government shuts down the business as a precaution. On the other hand, an endorsement may provide coverage for losses caused by communicable of infectious diseases without requiring physical damage to the property, which would implicate coverage. Another practical consideration is the amount of the sublimit in the endorsement, as many insureds may find themselves in the situation where, despite the fact that coverage is clear, the amount of coverage available is not enough to cover their losses.

B. Civil Authority Coverage

This type of coverage may apply when a civil authority prohibits access to the premises. Again, coverage will turn on the specific language of the policy as it may or may not require that the restriction result from a physical loss by a covered cause of loss. Further, the policy may not even require that the physical loss occur at the insured premises. Accordingly, if a governmental authority specifically restricts access to an area where the coronavirus has been identified, civil authority coverage may cover the insured business for the losses they incur due to the restriction. However, our analysis of this area of coverage indicates that coverage decisions will require a review of federal, state, county, and municipal orders as any of these authorities could potentially prohibit access to an insured premises.

C. Pandemic Coverage

While very few policies actually provide pandemic coverage, there will likely be a large wave of businesses seeking to add pandemic coverage for future events due to "panic buying." Even if a policy does include this coverage, most insureds may find that their pandemic coverage has very stringent conditions or have low limits that do not cover their losses. However, those without pandemic coverage may lobby both the state and federal government to create a pooled pandemic coverage with retroactive applicability to coronavirus shutdowns. One expert in the industry recommends that the federal legislature create a Pandemic Risk Insurance Act or amend the Terrorism Risk & Insurance Act to include pandemics and associated perils. In his article titled “Butler’s Risk Manager Calls for a Pandemic Risk Insurance Act,” Zachary Finn makes the point that a pandemic is akin to terrorism in the respect that both are too severe and unpredictable to be insurable, thereby creating the need for a retroactive safety net for the coronavirus while also creating a pre-funded risk pool for future events. Given the economic devastation that would result from mass uninsured losses and business closures, in addition to the likelihood that post-pandemic coverage for these perils will be nearly non-existent, the idea of a retroactive federal fund to cover these losses will seem appealing to all insureds.OptionsCreate: a Pandemic Insurance ActAmend: the Terrorism Risk & insurance Act to include pandemics and associated perils.

III. STATE LEGISLATION

Of course, the discussion above could be overwritten by the state legislature passing legislation essentially forcing insurers to provide business interruption coverage to businesses to help prevent mass economic failure and financial ruin for small businesses. The New Jersey state legislature has already introduced such a bill, introducing New Jersey Bill A-3844 which states, in part:“Notwithstanding the provisions of any other law, rule or regulation to the contrary, every policy of insurance insuring against loss or damage to property, which includes the loss of use and occupancy and business interruption in force in this State on the effective date of this act, shall be construed to include among the covered perils under that policy, coverage for business interruption due to global virus transmission or pandemic, as provided in the Public Health Emergency and State of Emergency declared by the Governor in Executive Order 103 of 2020 concerning the coronavirus disease 2019 pandemic.”This draft bill is limited to insured businesses with fewer than 100 full-time employees, and the coverage would still be limited to the business interruption limits included in the policy. However, this is obviously a very important development as the New Jersey legislature is overriding the express language of the policies at issue. A-3844 was passed out of committee on March 16 but was pulled from consideration before being presented to the full assembly. However, it appears that this does not completely defeat the bill, and so the issue must continue to be monitored closely.Massachusetts, Ohio, and Pennsylvania state legislatures have introduced similar bills, so it is likely that other states will begin to consider similar legislation that would apply retroactively to existing contracts. No such legislation has been introduced in Texas at this time.

IV. LOOKING FORWARD

As businesses begin to look to their insurers for coverage under their commercial property policies for losses sustained during disruptions to their normal business practices, the answer to whether the losses are covered will be highly individualized. Our firm is prepared to evaluate commercial property policies and navigate through these unprecedented claims, in addition to tracking how the rest of the nation is handling these types of claims so that we can stay ahead of the curve in providing advice to our clients.Hermes Law Case Architectūra for COVID-19 cases will allow us...to build transparency... manage risk, and standardize case management.Utilizing the Hermes Law Case Architectūra (HLCA) for COVID-19 cases will allow us, with you, to build transparency in the litigation activity and legal spend, manage risk, and standardize case management.What this means is that repetitive tasks such as preparing reservation of rights letters, denial letters, and coverage opinions for identical policies under similar factual circumstances will produce a level of automation and efficiency in our work product. This efficiency will generate immediate cost savings.At the macro level, the HLCA case handling component consists of the following:

• LITIGATION PLANNING REPORT

The Litigation Planning Report completed at the 15 and 45 day-mark, and quarterly thereafter on every case. It ensures progress, quality and value contribution of the legal service provider.

• INTERNAL AUDIT REPORT

The Internal Audit Report is maintained throughout the life of a file to ensure compliance with client requirements, court dead- lines, and Hermes Law's best practices and is provided at the close of a file.

• RISK MANAGEMENT RECOMMENDATIONS & CASE METRICS REPORT

The Risk Management Recommendations and Case Metrics Report provides an evaluation of the outcome of a case, performance of the legal service provider, and risk management recommendations for the client based on experience from handling the case.

• DETAILED BUDGETS

Detailed budgets by category of timekeeper and by the two layered coding set out in the Uniform Task Based Management System.

• VERDICT RANGE CALCULATORS

Verdict Range Calculators powered by our Case Valuations, with an 85% case valuation accuracy on resolved cases over the last three years.

Please feel free to reach out to a member of the team if you have any queries:

CAMERON SALEHI

Attorney at Hermes Law, P.C.214.749.6805 | cameron@hermes-law.com

REBECCA SIDE

Lloyd's and London Market Liaison+44 (0) 7834415977 | rebecca@hermes-law.com

DWAYNE HERMES

Founder at Hermes Law, P.C.214.749.6522 | dwayne@hermes-law.com